5 Easy Facts About Mileagewise - Reconstructing Mileage Logs Described

5 Easy Facts About Mileagewise - Reconstructing Mileage Logs Described

Blog Article

Not known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs

Table of ContentsHow Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.See This Report on Mileagewise - Reconstructing Mileage LogsNot known Facts About Mileagewise - Reconstructing Mileage LogsThe Of Mileagewise - Reconstructing Mileage LogsAll About Mileagewise - Reconstructing Mileage LogsThe smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is DiscussingThe Definitive Guide for Mileagewise - Reconstructing Mileage Logs

Timeero's Quickest Distance function suggests the fastest driving path to your employees' location. This feature improves efficiency and contributes to set you back savings, making it a crucial possession for services with a mobile workforce. Timeero's Suggested Course function additionally boosts accountability and efficiency. Workers can compare the suggested path with the real course taken.Such a technique to reporting and conformity streamlines the often complicated task of handling gas mileage costs. There are many advantages related to utilizing Timeero to keep an eye on gas mileage. Allow's take a look at a few of the app's most significant attributes. With a relied on gas mileage tracking tool, like Timeero there is no requirement to bother with inadvertently leaving out a day or item of info on timesheets when tax obligation time comes.

Mileagewise - Reconstructing Mileage Logs - The Facts

These extra verification measures will maintain the IRS from having a factor to object your mileage documents. With exact gas mileage monitoring technology, your employees don't have to make harsh mileage estimates or also stress about gas mileage cost monitoring.

For example, if a staff member drove 20,000 miles and 10,000 miles are business-related, you can compose off 50% of all cars and truck expenses. You will need to continue tracking gas mileage for work also if you're utilizing the actual expenditure method. Keeping gas mileage records is the only means to separate organization and personal miles and give the evidence to the internal revenue service

A lot of mileage trackers allow you log your journeys manually while calculating the distance and compensation quantities for you. Many likewise included real-time journey monitoring - you need to start the app at the begin of your journey and stop it when you reach your final destination. These applications log your beginning and end addresses, and time stamps, in addition to the overall range and repayment quantity.

The 5-Second Trick For Mileagewise - Reconstructing Mileage Logs

This consists of expenses such as gas, upkeep, insurance coverage, and the automobile's devaluation. For these costs to be taken into consideration deductible, the automobile should be used for service objectives.

Mileagewise - Reconstructing Mileage Logs - The Facts

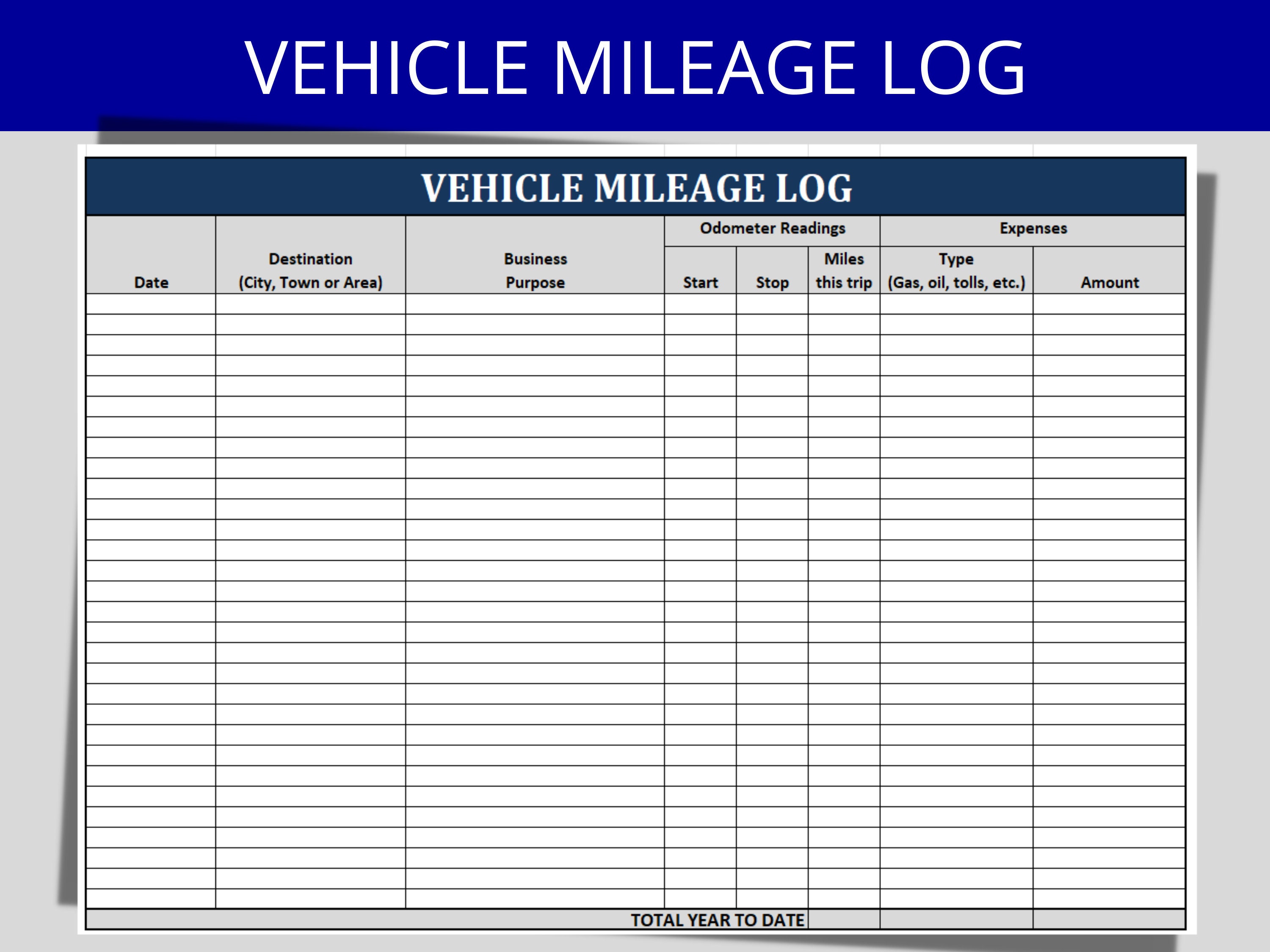

In in between, faithfully track all your service trips noting down the beginning and ending analyses. For each journey, document the location and organization objective.

This consists of the total organization mileage and complete mileage buildup for the year (organization + personal), journey's date, location, and objective. It's necessary to videotape activities without delay and preserve a contemporaneous driving log outlining day, miles driven, and organization purpose. Below's exactly how you can improve record-keeping for audit functions: Beginning with guaranteeing a precise gas mileage log for all business-related travel.

The 30-Second Trick For Mileagewise - Reconstructing Mileage Logs

The real expenses method is an alternative to the conventional mileage price method. As opposed to computing your deduction based upon a fixed price per mile, the actual expenditures technique permits you to subtract the real prices related to using your vehicle for business objectives - simple mileage log. These costs include gas, maintenance, repair services, insurance policy, devaluation, and other related expenditures

Those with considerable vehicle-related expenses or special conditions might profit from the actual expenditures this link method. Ultimately, your picked method needs to align with your details monetary goals and tax obligation scenario.

The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

(https://canvas.instructure.com/eportfolios/3331425/home/mileagewise-the-best-mileage-tracker-app-for-accurate-mileage-logs)Calculate your complete organization miles by utilizing your begin and end odometer analyses, and your taped business miles. Precisely tracking your specific mileage for organization trips help in corroborating your tax deduction, especially if you decide for the Requirement Gas mileage technique.

Maintaining track of your gas mileage manually can require diligence, however keep in mind, it might save you money on your taxes. Tape the total mileage driven.

9 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

In the 1980s, the airline market ended up being the very first commercial users of general practitioner. By the 2000s, the shipping industry had adopted general practitioners to track plans. And currently virtually everybody utilizes GPS to obtain around. That means nearly everybody can be tracked as they go concerning their service. And there's snag.

Report this page